Australian Tax Office Notice Of Assessment

You don t have permission to access this page using the credentials you supplied.

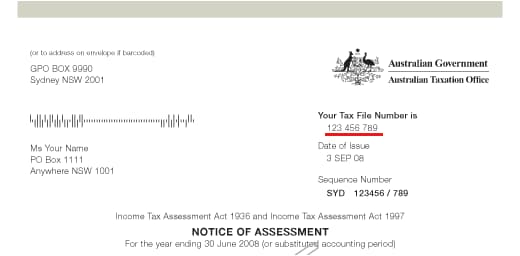

Australian tax office notice of assessment. For the 2020 year it is 6 10 weeks. If you have a mygov account your notice of assessment is sent to your mygov inbox. If you require a copy of a current or previous year s notice of assessment phone us on 13 28 61. Notice of assessment is issued by australian taxation office ato every time you lodge your tax return.

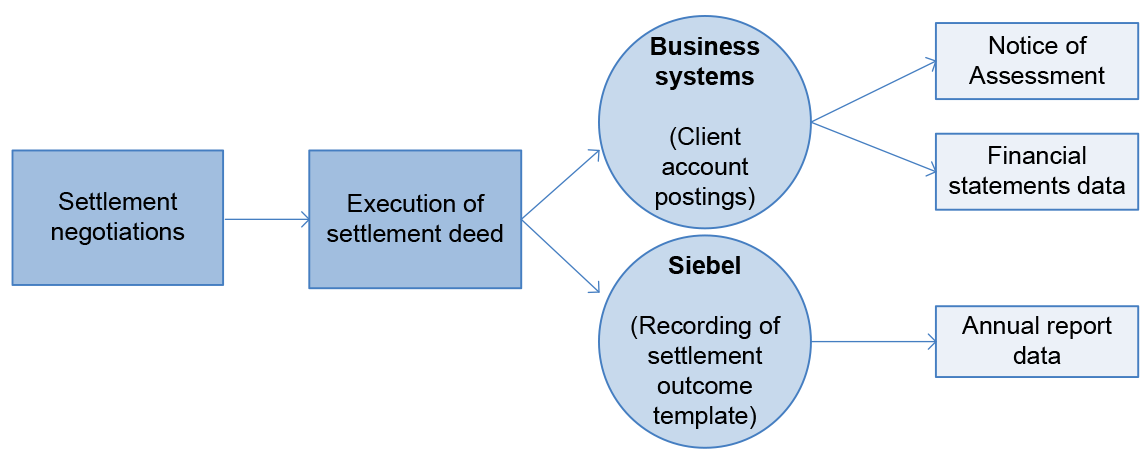

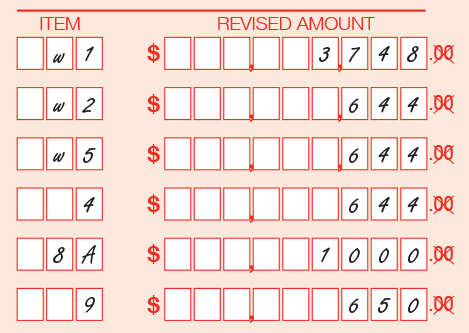

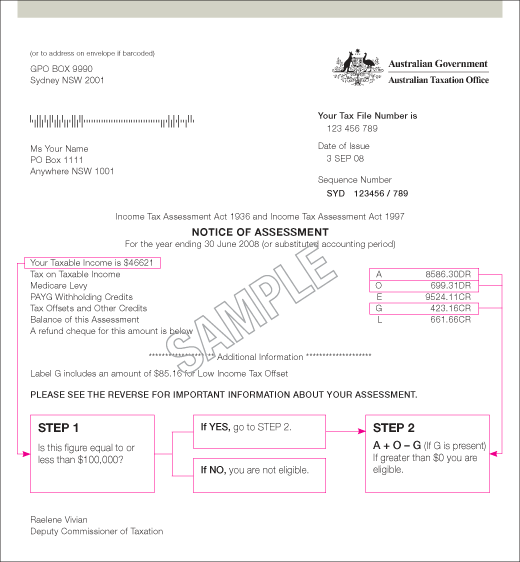

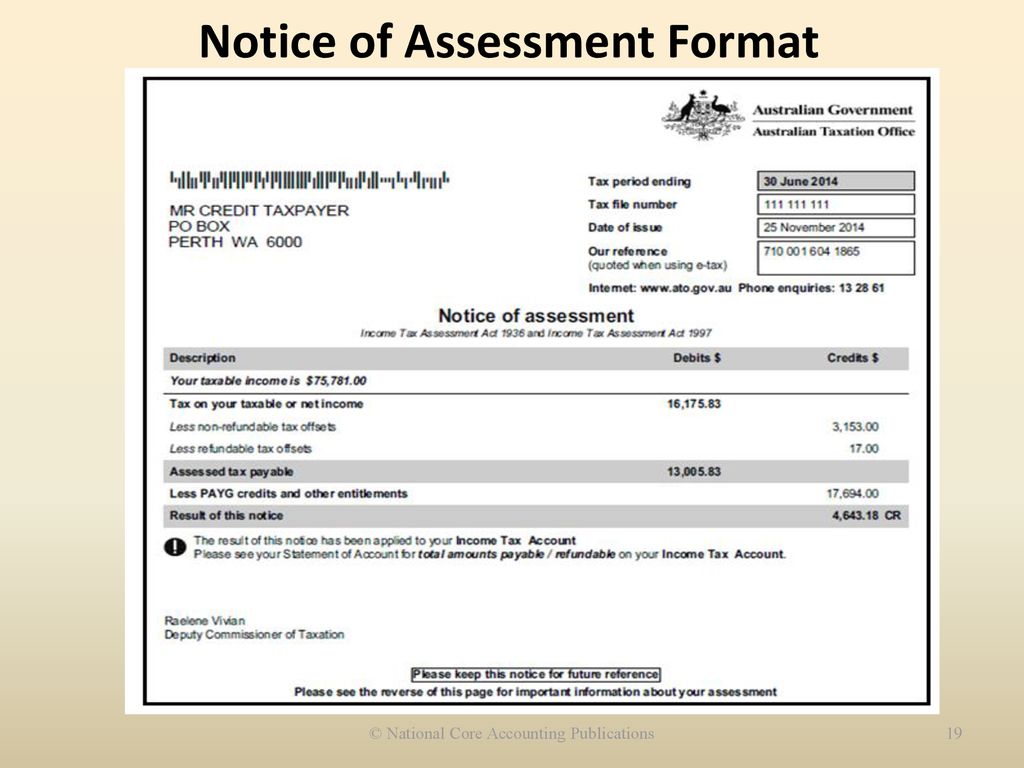

The notice of assessment we send you is an itemised account of the amount of tax you owe on your taxable income. An noa notice of assessment is a document you receive from the tax office when your tax return has been assessed. Your notice of assessment. It also contains other details that are not part of the assessment such as the amount of credit you have for tax already paid during the income year.

If it is your first time to do your tax refund you will not have this notice of assessment. In your tax return you must declare all of your income for the financial year. The tax office process time varies depending on which year was lodged. Working for all australians.

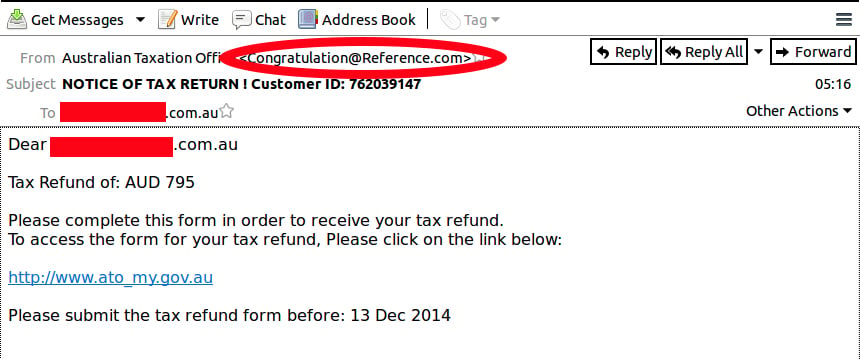

Ato and the mygov inbox. It is an itemised account of the amount of tax that you owe on your taxable income taking into account any tax offsets you are entitled to and contains other information such as the amount of credit you have for tax you paid throughout the year. For example if you work for an employer your employer will deduct tax from each pay and send it to the australian tax office ato on your behalf. Following is an example of how it looks like.

If the year you are after is not showing or you don t have a mygov account you can phone us on 13 28 61 between 8am 6pm monday to friday. Upon receipt of the australian tax office notice of assessment we forward your money to you by either direct deposit into an australian bank account or. For the 2019 financial year or earlier we can secure the refund in 7 14 days. Income tax is often paid throughout the year as you earn the income.

.png)